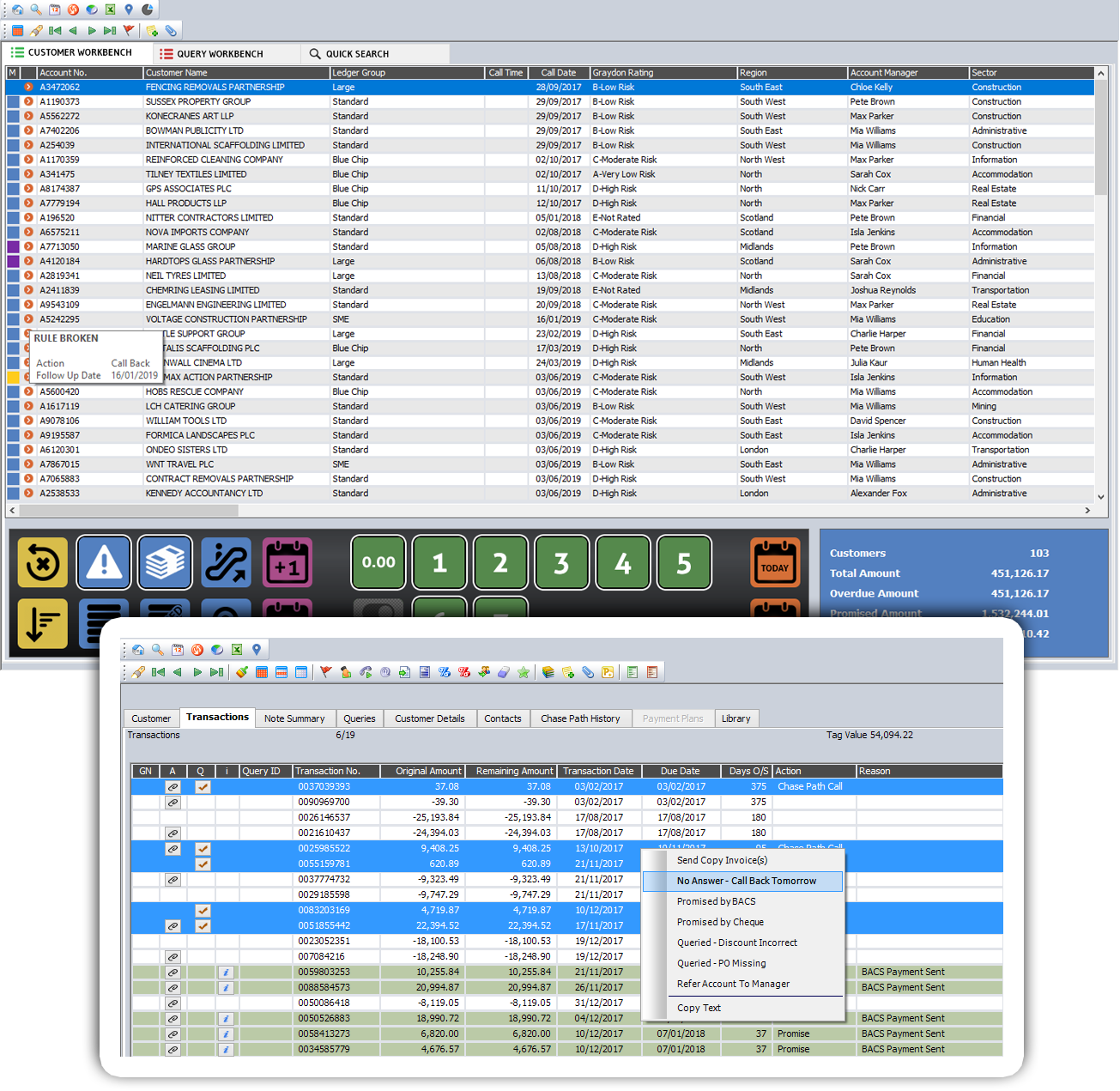

The Credica Cash Collection module has been designed around all of the needs of a Credit Control department. It provides your team with flexible worklists based around rules, alerts and AI, with a full overview of customer information, Aged Debt and all chasing history – this includes a diary function with automatic follow ups. Your dunning letters, statements and invoices are automatically printed or e-mailed based on your chasing policies – additionally, documents such as copy invoices and statements can be e-mailed on demand, with just a few clicks.

All of the above facilitates massive improvements to a crucial part of your order to cash process, and gives your team a focussed but interactive approach to managing debtors.

Configurable, workflow based chase rules.

We tailor your Credica system to suit the way you need to work. However, the majority of the system can be tailored by you to continue allowing you to improve and evolve your credit management processes whenever you need to.

You can very quickly enjoy the following benefits:

– Automatic Chase Letters

– Automatic Statements

– Invoices E-Mailed

– Intelligent work-lists

– Diary Follow-ups

– Visibility of problem areas

A single source of information

Everything that happens within your ledger is automatically recorded, dated, timed and named accordingly.

Your Credica system becomes a super-useful wealth of information, from all diary entries, notes, attachments, unlimited contact details, e-mails, invoices, statements. Pretty much everything!

No more single points of failure, just a single source of irrefutable information.

Diarised follow-ups

When dealing with customer requests, you can benefit from the built-in diary system.

This is used to automatically track and follow-up unpaid debt, whilst serving your customer. For example, sending copies of invoices is a diary action – although Credica sends these out as part of the diary action, the debt is still unpaid and needs to be tracked. Credica does all of this for you.

This also contributes to reporting and analysis, for example Credit Controller Activity, and Promised Cash.